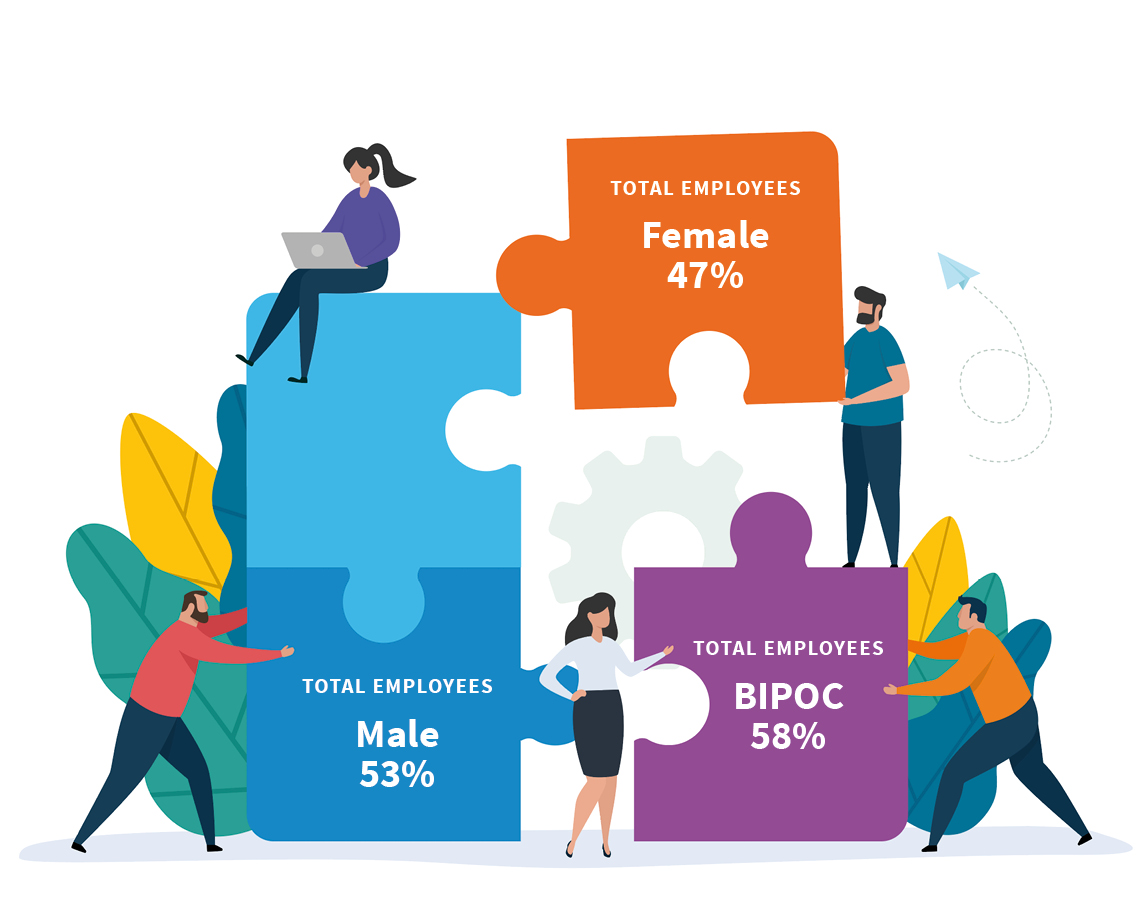

Total Employees

Female … 47%

Male … 53%

BIPOC (Black, Indigenous, People of Colour) … 58%

Genus Leadership Team

Female … 67%

Male … 33%

BIPOC … 56%

Genus Board of Directors

Female … 40%

Male … 60%

BIPOC … 40%

Genus Shareholders

Female … 38%

Male … 63%

BIPOC … 38%