Genus Webinar

Are you ready?

A seismic shift is occurring.

Talk to a Genus team member about offering impact investing solutions for your clients.

Chief Sustainability Officer / Partner

Mike Thiessen,

CFA, MBA

The State of Impact

Investing Today

A seismic shift is occurring. Clients and the markets are increasingly expecting financial institutions to evolve their offerings to align with broader industry sustainability and impact goals, and regulatory standards while maintaining a keen focus on economic performance.

Demand for impact investing is growing as global wealth is transferring to the hands of investors who prioritize sustainable wealth accumulation and preservation.

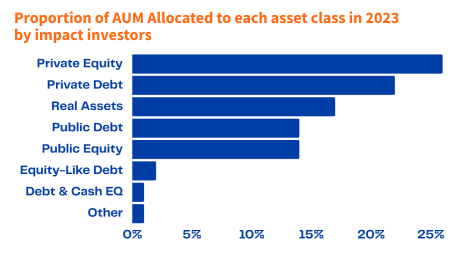

Source: 2023 GIIN Insights – Impact Investing Activity, Allocations & Performance

Impact investing today is highly concentrated in private equity, private debt and alternative strategies making it unsuitable for the average investor’s risk profile.

Why Impact Equity is a

Robust Impact Solution

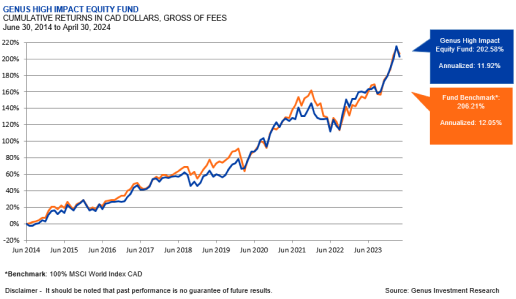

The Genus High Impact Equity Fund offers the ‘sweet spot’ between your clients’ financial needs, risk tolerance and sustainable investing objectives.

- Impact: Uses proprietary quantitative tools and research to analyze and identify high-impact investment opportunities.

- ESG: Utilizes material criteria to mitigate underperforming entities involved in controversies spanning product lines, supply chains and organizational process.

- Financials: Leverages deep quantitative models to assess corporations across a multitude of factors to identify high-quality businesses with a proven track record.

The result: A high-impact focused portfolio that uses constructive engagement to enhance measurement practices and actively pursue incremental positive impacts.

The Genus High Impact Equity Fund

This fund is for investors who:

- Seek growth through capital appreciation

- Have a medium tolerance to risk

- Seek to participate in impact investing

- Seek sustainable values alignment

- Plan to hold their investment for the long term

About genus

Helping you build a

better future

Genus is one of the leading providers of values-based investing strategies including responsible, fossil free, and impact investment strategies with 35 years of investment innovation experience. We’re proud to be a certified B Corp since 2017.

Some of our public clients

Learn more about the Genus

High Impact Equity Fund F-Series

Chief Sustainability Officer / Co-Chief Investment Officer / Partner

Mike Thiessen, CFA, MBA

Copyright © 2024 Genus Capital Management Inc. | All Rights Reserved

Sitemap | Privacy Policy | Third Party Policy | Investor Information | Contact Us