6 Key Investing Strategies for Unstable Markets

We all know that markets are cyclical, but when there’s a marked downturn or ongoing turbulence it can be tempting to try to cut your losses by selling off investments. Reacting with emotion can actually have the opposite effect, derailing your long-term investing plans, and costing you in the long run.

Jill Bester, Client Relationship Manager at Genus Capital Management, explains how Genus works with you to keep your portfolio steady, even when markets and interest rates are all over the map.

Look to Long-term Market Trends

While apps and news alerts make it easy to stay up-to-date on stock market performance and your investments’ fluctuations, Bester says they also distract you from focusing on the big picture, whether you’re building wealth, preparing for retirement or drawing an income from your investments. And that can be riskier than staying the course.

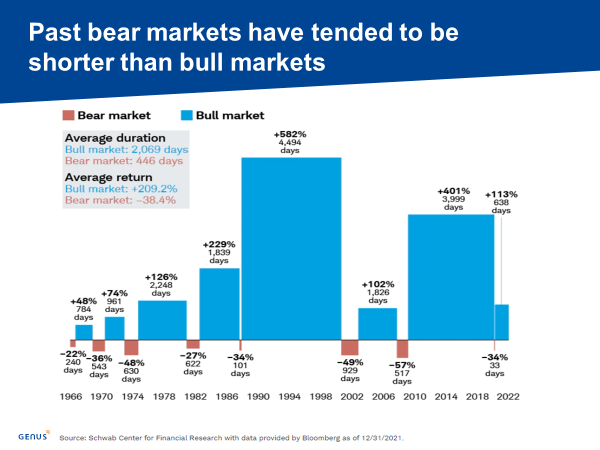

“We listen to our clients’ concerns in regard to market volatility, but we really try to refocus them toward their long-term investment goals,” says Bester. She uses tools like index charts to show the market’s history and how quickly it has recovered in past market corrections.

Understand Financial Behaviour Biases

Bester taps into behavioural finance, a field of study that examines human economic behaviour and financial blind spots – to help clients understand how to separate their emotions and their financial decision making processes. “There’s something called an emotional gap, and it refers to decision making based on extreme emotions, or emotional strains such as anxiety.”

Those gut reactions and fears are often why people don’t always make rational choices when it comes to their investment portfolio – particularly when markets are down. “We are there as their coach to support and guide them through the volatile times,” she says.

Look for Proactive Portfolio Management

The market’s best days are often followed by its worst days, and experienced portfolio managers know this. That’s why the Genus investment team meets daily to analyze its equities and decide whether to buy, hold or sell.

Genus’ portfolio managers intentionally design investment portfolios to withstand volatility, and during periods of instability in the markets, they proactively contact clients to check on their income requirements and make sure they have a cushion in case of a crash. “You should always have that income set aside for this very purpose,” says Bester.

Diversify to Reduce Risk

While market volatility is top of mind for investors, climbing interest rates are another factor in investment decisions.

A diversified portfolio – one that balances safety of capital with some growth – is what many of Genus’ clients opt for as a way to weather what Bester describes as “two separate storms” that are creating anxiety among investors: stock volatility and the effect of rising interest rates on bonds.

Although every portfolio is tailored to each client’s needs and goals, Bester says a balanced investor’s asset mix, for example, would be about 40% in fixed income, primarily bonds and commercial mortgages, which are highly impacted by rising interest rates.

Use Dollar-cost Averaging to Smooth the Bumpy Road

Since there’s no way to predict when the market will swing upward or downward, Bester recommends dollar-cost-averaging, “the practice of systematically investing equal amounts of money at regular intervals, regardless of the price of securities.”

Dollar-cost-averaging can reduce the overall impact of price volatility and lower the average cost per share. Ultimately, it can help smooth out what’s been a bumpy road for investors

Always Keep a Long-term View

During the financial crash of 2008, many people pulled the proverbial parachute, exiting the market. But doing so cost them dearly. “That created financial disasters for many, just because they sold low and didn’t actually have that one contact with their advisor telling them to focus on their long-term investment goals.”

Many of those people would then have missed out on an 11-year bull market between 2009 and 2020. “We don’t recommend market timing,” says Bester. “You have to remain in the market to achieve your long-term goals. It’s as simple as that.”

A Genus advisor can help you make sense of the markets and your investment strategy. Get in touch today.