Watch on Demand: Beneficiary Designations Webinar – We Need to Talk Webinar

Topics

- New case law applying the presumption of resulting trust in favour of the estate to all beneficiary designations & what to do about it

- Advantages, disadvantages and limitations to beneficiary designations

- Form of designation

Terminology (successor annuitant, etc.) - Taxes

- Forcing a roll-over to spouse in blended families

Avoiding the unintended consequences of beneficiary designations – What you need to know before you sign the forms.

Understanding the implications of adding a beneficiary designation in RRSPs, RRIFs, Tax-Free Savings Accounts, and life insurance policies can help you avoid or prepare for potential consequences in the long run. Join us as we walk through recent real-world court cases addressing how these designations can backfire.

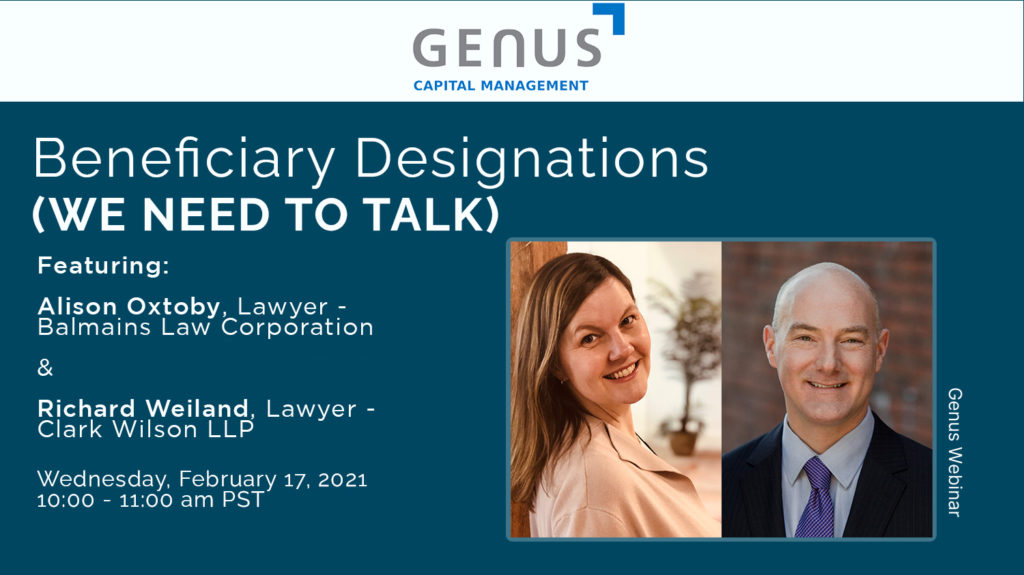

Join keynote speakers Alison Oxtoby – founder of the Balmains Law Corporation, and Richard Weiland, Partner with Clark Wilson LLP as they explore the many avenues of beneficiary designation. Drawing on their broad experience, Alison and Richard will give listeners the tools they need to avoid mistakes they see far too often.

Alison Oxtoby, TEP – Balmains Law Corporation, Okanagan

Alison Oxtoby is the founder of the boutique Okanagan law firm of Balmains Law Corporation, where she works primarily in the areas of trusts, estates and corporate law. She is a frequent presenter for a variety of professional organizations, including the Canadian Bar Association and the Chartered Professional Accountants of BC.

She is also an active member of the legal community, having served in many roles over almost 25 years of practice, including as an executive member of the Canadian Bar Association’s BC Branch, on the Judicial Advisory Committee of BC, as Chair of her local chapter of the Society of Trust and Estate Practitioners, and as the Current President of the Kelowna Estate Planning Society.

Richard Weiland, TEP – Clark Wilson LLP, Vancouver

Richard Weiland is a partner with Clark Wilson LLP practicing in the areas of tax, estates and trusts. His practice has an emphasis on advising business owners and families on tax, estate and philanthropic matters.

Richard has taught Taxation of Trusts and Estates at the Peter A. Allard School of Law at UBC as an adjunct professor, and has authored chapters for publications by CLEBC on estate planning and administration issues. He is a regular speaker and author for both legal and non-legal audiences.