Everything we do — and every choice we make — has a net impact on the planet and society.

Consider your choice of morning coffee. By buying your chosen brand, you are inherently supporting not only the company that makes it, but also all of that company’s suppliers and distributors, too. With one seemingly small decision, you’ve created a cascading effect of impact. In this way, every one of us can be a changemaker.

All portfolios make an impact, and the impact can be positive, negative or a bit of both. Some impact-focused investors prefer to screen out as much negative impact as possible from their portfolios, while others aim primarily to support companies making a positive net impact.

All investment portfolios make an impact. Is yours positive? Negative? A bit of both?

At Genus, we’ve created Fossil-Free™ and Impact investing solutions to create positive impact. More specifically, we’ve divested of companies that have a negative effect on society and the planet.

Introducing the Net Impact Score™

The net impact score is a tool we’ve developed to account for both the beneficial and the destructive nature of investments.

We evaluate all of our investments according to the United Nations’ 17 Sustainable Development Goals, which include eradicating global poverty and hunger, boosting gender equality, health and well-being, providing for basic needs like clean water and education, protecting life on land and in water, furthering climate action and driving positive innovation, among others.

Companies that derive 100% of their revenue from products and services that meet one or more of these 17 goals would receive a score of 100% positive net impact. Conversely, businesses that derive most or all of their revenue from products or services that negate these goals (think tobacco, oil and gas, gambling, adult entertainment, factory farming and GMO, junk food, etc., would receive a negative impact score.

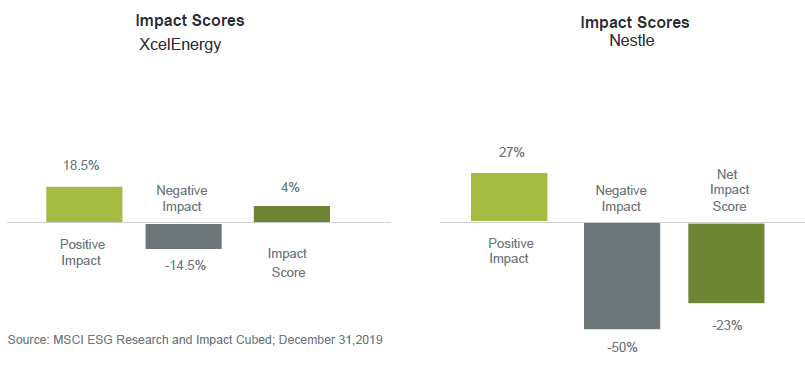

Most investment portfolios have both positive and negative impact scores. The net impact score is the positive impact score minus the negative impact score. Here are some examples of what that can look like:

Thiessen says the average investor — “even someone who is socially and environmentally conscious,” probably has a lot of negative impact in their investment portfolio without necessarily realizing it. “If you have a traditional Canadian portfolio, it’s going to have lots of companies that extract, process, or transport oil and gas, because they make up about 24% of the Toronto Stock Exchange,” he says. “Most Canadian funds are going to have a negative impact, while most global funds have a neutral impact.”

Genus’ Fossil Free High Impact Equity Fund investment portfolio achieves its positive net impact by investing in areas such as health care, technology and alternative energy companies. “Our Fossil Free High Impact Equity fund typically has a higher health care allocation than the market,” Thiessen says. “And it includes industrial companies creating new, innovative energy efficient technologies,” such as Vestas, which designs, manufactures and installs wind turbines and happens to have a 100% net positive impact score.

So, do you know the net impact of your investments? We can help you find out — and ensure you’re making the kind of impact that aligns best with your values.

Learn more about the impact of your portfolio or get in touch to chat about how we can help increase your positive net impact.