There’s a persistent myth in investing circles that sustainable investing requires a financial performance trade-off.

We’d like to put an end to that myth here and now.

Because it simply isn’t true.

But before we show you the proof, let’s take a look at how this myth came to be.

How the myth of low returns began

Before sustainable investing was a multi-trillion dollar market, it essentially started as philanthropy. Investors would put their money into enterprises doing good (but possibly not very profitable) work, without any expectation of financial gain.

As the sustainability sector grew, sustainable investing became more lucrative. But the original investment mentality was tough to shake. “A lot of the early sustainable investments came out of an impact-first mentality,” says Mike Thiessen, director of sustainable investments at Genus. “Impact was the number one goal, and if they made returns, it was considered a bonus. Add to that the fact that a lot of people have made a lot of money from resource extraction. So the thought of cutting it out and doing better was hard to swallow for some.”

It’s an attitude that has persisted in some circles despite evidence that sustainable investing today not only produces returns, but often outperforms traditional investments. “Many people still can’t wrap their heads around the fact that they can make money while making an impact,” Thiessen says. “But the reality is, they can have the best of both worlds.”

With sustainable investing, you can have the best of both worlds: making an impact, and a solid financial return.

Mike Thiessen Tweet

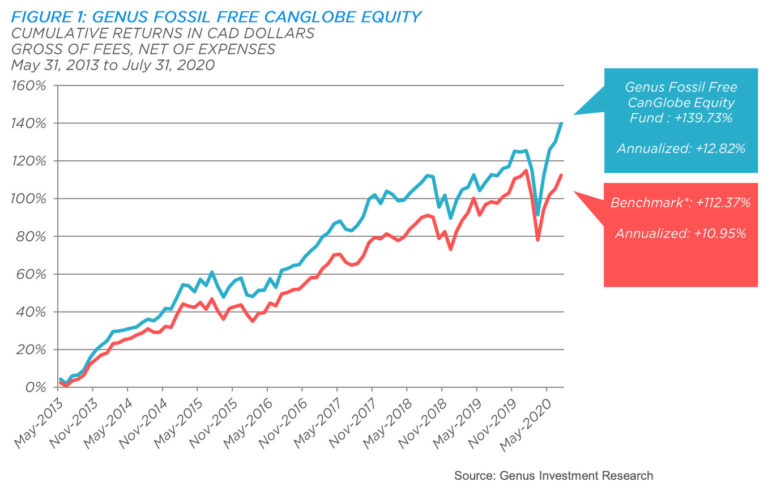

Our recently released 2020 Divestment Report examined seven years of Genus Fossil Free portfolio performance and found that: “The climate-friendly Genus Fossil Free CanGlobe Equity Fund has beaten its benchmark* on an annualized basis for the period of May 31, 2013 to July 31, 2020:

- The fund generated a 12.82% annualized return;

- The equity fund’s benchmark*, against which performance is measured, generated 10.95% for over seven years ending July 31, 2020.” *Benchmark: 25% S&P/TSX Composite, 75% MSCI World (06/30/2020-Present)

Source: Genus 2020 Divestment Report. *Benchmark: 25% S&P/TSX Composite, 75% MSCI World (06/30/2020-Present)

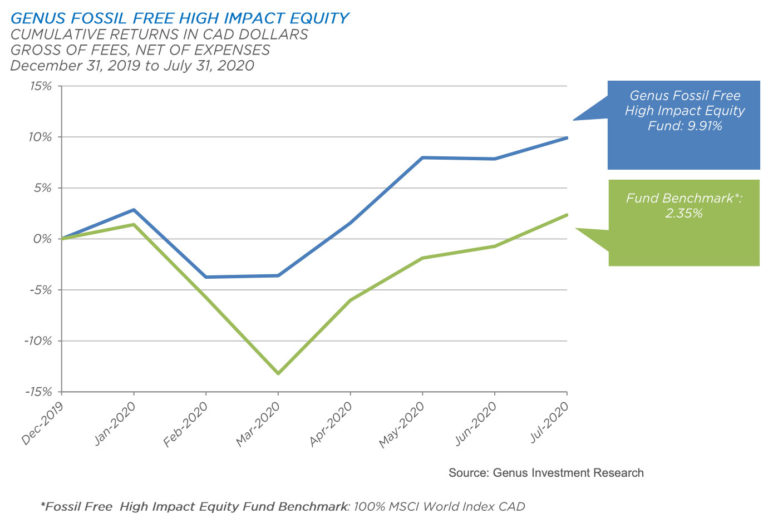

Our research into the performance of divested portfolios over 9 and 21 year time periods has also shown that divesting from fossil fuels would have had a positive effect on returns, without significantly increasing the volatility of sustainable investing.

But it’s not just our research that disproves this myth.

Morningstar Canada recently released its performance review of Canadian sustainable investments for the second quarter of 2020, and the results were “impressive,” according to Ian Tam, director of investment research. “Morningstar ranked 88 sustainable investments over the first half of 2020, and we found that 63 of them, so the broad majority of them, actually outperformed their peers. Moreover, 35 of them placed in the top quartile of their respective peer groups over the first half of the year.”

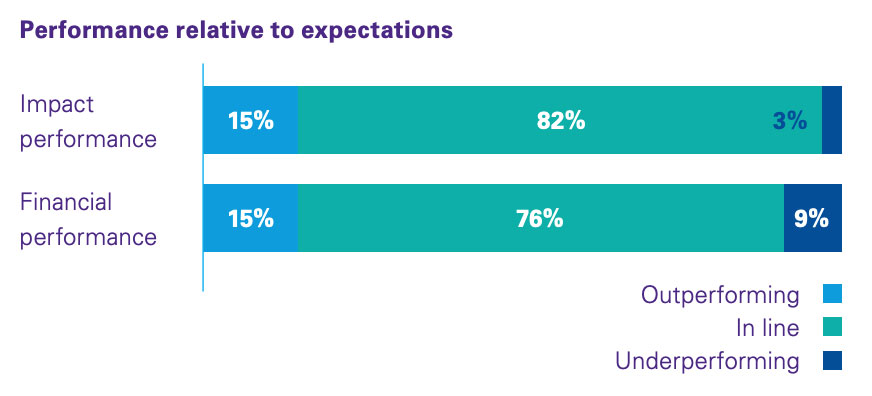

Morningstar found similar results for US ESG funds. And according to a 2019 KPMG report, “Overwhelmingly, impact investors report performance of impact investment funds in line with both financial and impact expectations.”

ESG investments may actually reduce risk for investors

And that means more opportunities for ESG investors to have their cake and eat it too.

Know more about ESG and how does it factor into your sustainable investing strategy?