Have a question? We would love to hear from you! Send any questions you have to questions@genuscap.com and we’ll address them at next week’s update.

Leslie Cliff: [00:00:00] Well, welcome. This is Genus fourth weekly look at the markets after during their virus event. Wayne we talked about the three stages of what the market does in these kinds of instances, the first being a panic, which is really caused the market to go down about 50 percent from mid January to both March 22nd or so. And the market’s up twenty five percent off the bottom. Very nice bounce. So what’s driving all that?

Wayne Wachell: [00:00:32] Well, this week, the big the big news was the pandemic cresting at crested and the market went up with that. And so that’s the market has been looking for that. It happened it happened on time, very similar to China. And the second big factor this week was the Fed undertook shock on, and they’re coming in big time. There is a two point three trillion dollar loan facility in place for businesses.

Leslie Cliff: [00:00:55] Yeah, I know these numbers get meaningless because they’re so big after a while, but this is on top of two weeks ago of 2.2 trillion which is shock-and-awe back then. Tell tell us what this has done to the bond market.

Wayne Wachell: [00:01:08] Well, that and also the fact they’re coming, they’re actually buying corporate bonds. They’re buying junk bonds. They’re buying corporate ETF. Has had a dramatic impact on the corporate bonds. The big corporate bond ETF in the U.S., the LAPD, is now flat for the year after being down probably almost 20 percent. That’s amazing. They’re moving. They’re the buyer moving the whole market. Junk bonds are spreads have come in dramatically. And the junk bond ETF this morning today was up like five, 6 percent. Two weeks ago, Ford Motor bonds were downgraded to junk; Today, they were up 20 dollars. And so that’s the Fed. They’re coming in. They’re the buyer of last remark resort. They’re holding these these junk bonds up effectively. And they will they will buy. Ford has to issue bonds. They’ll be there probably buying them. This kind of gives. This is kind of dangerous in some ways. And basically it’s it’s moral hazard. Where does it stop? How long will it go on? For two months. For three months or four months. What happens after six months may still be in doing this? So it’s it’s they’re coming in big time.

Leslie Cliff: [00:02:14] I think one of the things that’s concerning that’s great that they’re doing is that it has to be done because liquidity is a huge problem. These kinds of markets and can hear the Humpty Dumpty theory today. If Humpty Dumpty crashes, you can’t put it back together again. So it’s really important that they come in and done all this. But the fact that the 10 year U.S. government bond yield is still on as low as 72 basis points, tells me that there’s still a lot of uncertainty and fear out there because that should be going up. Because it is obviously inflationary. Interest rates should rise across the board, but they’re not there. They’re only rising where the Fed’s buying.

Wayne Wachell: [00:02:53] Yeah, I think that’s that’s a big tell. We’re we saw gold move a bit to the course of this week here. It was up 2 percent today. And with all the money printing going on, we anticipate going longer, trying to break out where we’re overweight gold miners at this point in time. We have gold in our global macro strategy. But they’re printing so much money and it’s going to have implications longer term. You know, I’m on my senses. I’ve been in the business for 40 years. And for 40 years there’s been disinflation. Rates have fallen for 40 years. My sense is we’re coming to an end of that and we’re going into an epoch, where it might be inflation, where the governments are involved in putting too much money and getting too hands on the economy. I don’t know where it’s going to end up, but I think this is the era we were in. We grew up career-wise is coming to an end.

Leslie Cliff: [00:03:41] Well, no, I remember it before it 1981. It’s a few years, but it was when Volcker got inflation under control in the early 80s.

Leslie Cliff: [00:03:52] So this leads us to the obvious question of the third issue. This is the retest. And we talked about this last week. You know, everybody’s talking about a retest, although less this week. I we’re still nervous about that, aren’t we?

Wayne Wachell: [00:04:08] Yes, we’re still concerned about that. And stocks have done so well here. We started shaving some equity in our our global macro strategy, is more of a trading thing. We’re looking at our other accounts as well in coming weeks as well. We’ve got a percent retracement here and our equity basis has actually gone up. So you just want to reduce those back to where they were prior to this rally. And then we’ll take a look.

Leslie Cliff: [00:04:31] By Balance. We talked about it before.

Wayne Wachell: [00:04:33] And we are global macro models came out this month and our world cash model, which was positive last last month and before the pandemic, has gone to kind of flat to negative. And so that’s giving us pause. What’s going on there is a lot of the indicators, the risk indicators are really off the charts and they’re knocking down the models, a bicycle effectively. And so we want to watch that and take it. So some there’s some caution. Here, I still think we’re going to get a bit of a correction from where we are today. Maybe we might go a bit higher here. But I think once we start digesting earnings and the mess out there, there’s room for maybe a retest, maybe not all the way, but, you know, some some downward movements here before we go on from there. But we’ll be watching our indicators and signals and making rate adjustments.

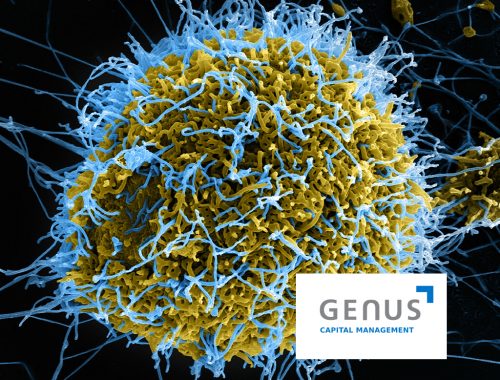

Leslie Cliff: [00:05:24] Well, I just want to talk about the virus for a minute. Just because the markets and the virus are so interconnected. It just that there’s a great article in The Economist this week about how do we kickstart this, how do we get going again? And, you know, we’ve discovered that globally we have these fantastic public health people, including our famous doctor, Bonnie Henry here in British Columbia who we all love, but they are rightfully so totally focused on the virus. It seems that in order to restart the economy, we need leadership to look at things like suicide rates, abuse, critical heart, critical cancer care, other things that are being put on hold, including going to work. Well, we put on these draconian appropriate measures to get the curve flattened, but it’s going to take very wise leadership to create policies that get us restarted because vaccine if you listen to Bill Gates today, you can Google him. He’s on Fox and PBS is great interview. Just listen. It’s it’s not going to be solved overnight. So we have to get going. So we need these global leaders. I can we say thank God Angela Merkel is still in involved and thank God Boris survived. And I hope that other countries can step up. You see Singapore and Japan, a second wave happening. So we need global leadership. And the one country that starts to get it right, whether it be Sweden or anybody, we can all copy them, need to learn from each other. The scientists are cooperating. It’s really unbelievable. But we’re far from from out of this mess. And that’s one of the things I want to make sure the clients know is that this balances is, you know, it’s got some air under it.

Wayne Wachell: [00:07:18] Well, the revenues a cost benefit here and we’ll see how this how this plays out in terms of the impact on our life and then even people that can’t get care right now that have other medical issues.

Leslie Cliff: [00:07:30] Right. Just quickly, what have you done this week? Not stocks, just big picture. You don’t normally do big rebalancing weekly. Have you done anything this week?

Wayne Wachell: [00:07:43] Well, we didn’t. What we did within our our balanced funds. We actually we bought some more of our global macro bond fund. And so some corporate bonds to do that, we’re looking at actually reducing some equities, probably bring them to cash over the next couple of weeks. Within the equity funds, it was a good week for value, for risk taking, if you will. So value stocks came back this week. We’ve been adding to value somewhat. We actually the course of week, we actually sold some health care, for example, and bought some some banks that are higher quality ones. And that’s really the extend of it.

Leslie Cliff: [00:08:19] Right. So. I think we should wrap this up. I’m sorry. I have a couple of great questions, but there on another paper in another room and I forgot. Next week, I promise we’ll get to your question. Sorry about that. But it is Easter weekend. It’s a tremendous, important weekend culturally for all of us. Different religions are not religion, but it’s a special time. So I wish you all a very happy Easter weekend and rest assured, were hard at work overseeing your financial situation. Thank you very much.

Wayne Wachell: [00:08:57] Thank You.