As Baby Boomers begin passing down their wealth in what’s known as the Great Wealth Transfer, experts expect up to $68 trillion will change hands in the coming years. And this transfer will have huge implications on the growing demand for values-aligned impact investment products that can help to power positive change.

We asked two Genus client relationship managers – Jill Bester and Thomas Irwin – for their best strategies on preparing for retirement in every decade. Here’s what they said.

We’ve already seen several high-profile examples of wealth being passed down for good: last year, the founder of Patagonia donated his entire company to fight climate change. And before that, Bill Gates announced plans to give most of his fortune to charity.

But the next generation of investors is doing it differently. Millennials are poised to take over much of the stewardship of the transferred wealth (after it goes to women first), and there’s a good chance they’ll allocate some of it to impact investing. Studies have shown that Millennials are more likely to choose impact investing over charitable giving, upholding the belief that aligning values with investment practices is a powerful tactic for driving change. And as the largest generation in American history, they will have the power to shift the way we do things for the better.

Turning the tides on traditional investing

In 2018, Vancouver-based impact investment leader Joel Solomon wrote The Clean Money Revolution, a book detailing not only his personal journey in impact investing, but also the opportunity that exists in the coming 30 years to turn the tides on traditional investing practices. “We are our money,” he wrote. “All of us in the money business must take responsibility for where our capital is… what it is doing, and who it is helping or harming.”

Solomon, a founding Partner of Renewal Funds, Canada’s largest mission venture capital firm, believes Millennials are the turning point. After all, we’ve seen how they’re already aligning their values in the workplace, as their expectations of their employers have grown in recent years to include action on issues such as sustainability, diversity, equity and inclusion.

And they’re taking the same approach with their investments. “Millennials are already insisting that their portfolios, self-generated or inherited, be values-consistent, ethical, sustainable, and just investments,” Solomon wrote. “It’s an awakening driven by love. Love is a shorthand way of saying that we must show we care by acting on our values, ethics, and morals – for ourselves, our families, all life on the planet, and the future.”

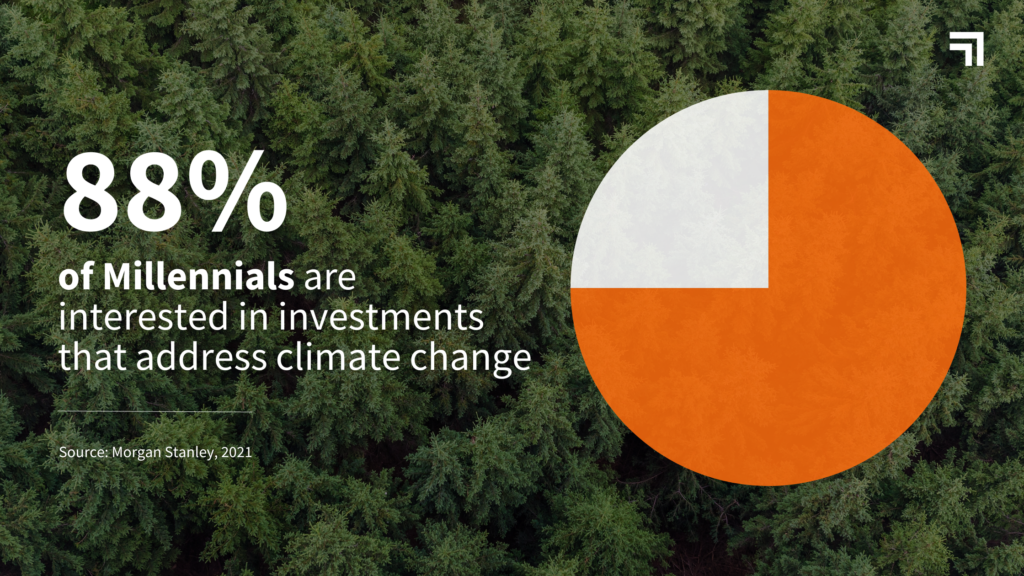

And as for the future, according to a 2021 Morgan Stanley report, 88% of Millennials are interested in investments that address climate change. Taking action against it with their investment portfolio is just one of the ways they’re choosing to accelerate the development of sustainable practices and products that can help to preserve and protect the planet.

A new way to steward an inheritance

Of course inheriting any sum of money can come with a host of complicated emotions that can affect how a person chooses to manage that financial wealth. “There are differing styles of inheriting,” says Grant Conroy, Portfolio Manager at Genus. “And that’s something that’s not really talked about. Some people shy away from financial wealth, while others simply want the money to do some good.”

Conroy has also seen a generational difference in the approach to putting wealth to work. “Older generations have had impact through philanthropy. They maximize impact by giving to a charity and don’t expect a return,” he says. “Younger generations often think of impact investing instead of philanthropy – still looking to have a positive outcome as well as making a return.”

When it comes to bridging that wealth-transfer gap between generations, Conroy says the most important factor is to talk about it before the transfer takes place. “There’s a lot of important work to be done, depending on what everyone’s definition of success is,” he says. “ Transferring wealth is not just about dotting Is and crossing Ts on legal documents. It’s important to communicate.”

Conroy notes that when he works with families preparing for wealth transfer, he strives to help them share their respective visions for the future, and come to an agreement on what the wealth will be used for. “For example, do they value certain causes?” he says. “And what is the purpose of the money to benefit future generations?”

Of course, whether or not you’re on the receiving end of the wealth transfer, you can still choose to put your money to work for good – and now is a great time to get involved in impact investing. As Solomon wrote in his book: “Our purpose can no longer be simply to amass and hoard ever-larger amounts of capital, whether for ourselves or for shareholders. There’s no good future in that. There is a great future in basing our economy on making a contribution, and using some of those better elements of capitalism to spread positive results.”

Interested in exploring how a wealth manager can work with your family to manage the wealth transition? Contact a Genus advisor to get started.

References

- Dickler, J. (2022) Strategies to navigate the $68 trillion ‘great wealth transfer,’ according to top-ranked advisors, CNBC. Available at: https://www.cnbc.com/2022/10/17/how-to-navigate-the-great-wealth-transfer-according-to-top-advisors.html (Accessed: 08 May 2023).

- Laker, B. (2023) Demand for impact investing is rising. here’s why, Forbes. Available at: https://www.forbes.com/sites/benjaminlaker/2022/11/17/demand-for-impact-investing-is-rising-heres-why/?sh=5aed3ca9285f (Accessed: 08 May 2023).

- Kolodny, L. (2022) Patagonia founder just donated the entire company, worth $3 billion, to fight climate change, CNBC. Available at: https://www.cnbc.com/2022/09/14/patagonia-founder-donates-entire-company-to-fight-climate-change.html (Accessed: 08 May 2023).

- Jr., T.H. (2022) Bill Gates plans to give away ‘virtually all’ his $113 billion-here’s the impact that could actually have, CNBC. Available at: https://www.cnbc.com/2022/07/15/bill-gates-plans-to-give-away-virtually-all-his-113-billion-fortune.html (Accessed: 08 May 2023).

- (2023) The intergenerational wealth transfer will affect women first. here’s what you need to know, Genus. Available at: https://genuscap.com/the-intergenerational-wealth-transfer-will-affect-women-first/ (Accessed: 08 May 2023).

- Garrido, P. (2022) Millennials choose impact investing over charitable giving , Impact Investor. Available at: https://impact-investor.com/millennials-more-likely-to-become-impact-investors-survey/ (Accessed: 08 May 2023).

- Joel Solomon (no date) About joel, Joel Solomon. Available at: https://joelsolomon.org/about/ (Accessed: 08 May 2023).

- O’Boyle, E. (2023) 4 things gen Z and millennials expect from their workplace, Gallup.com. Available at: https://www.gallup.com/workplace/336275/things-gen-millennials-expect-workplace.aspx (Accessed: 08 May 2023).

- Morgan Stanley | Global Leader in Financial Services. Available at: https://www.morganstanley.com/assets/pdfs/2021-Sustainable_Signals_Individual_Investor.pdf (Accessed: 18 May 2023).

- (2023) Why now is a great time to get involved in impact investing. here’s how, Genus. Available at: https://genuscap.com/why-now-is-a-great-time-to-get-involved-in-impact-investing/ (Accessed: 08 May 2023).