When the diversity and inclusion movement intensified last year, we at Genus registered to participate in the inaugural RIA D&I Week, a diversity and inclusion conference for wealth management and investment professionals, to keep ourselves informed and up-to-date on the latest best practices within our industry.

As we engaged in various workshops on the importance and value of diversity in the workplace — and particularly in the financial sector, where diverse groups haven’t traditionally been well represented — we felt the kind of pride that comes with knowing we’ve been on the right track since our beginnings over 30 years ago.

Back then, Genus was founded by a diverse duo of investment professionals — Wayne Wachell and Leslie Cliff — diverse both in terms of gender and ethnic background.

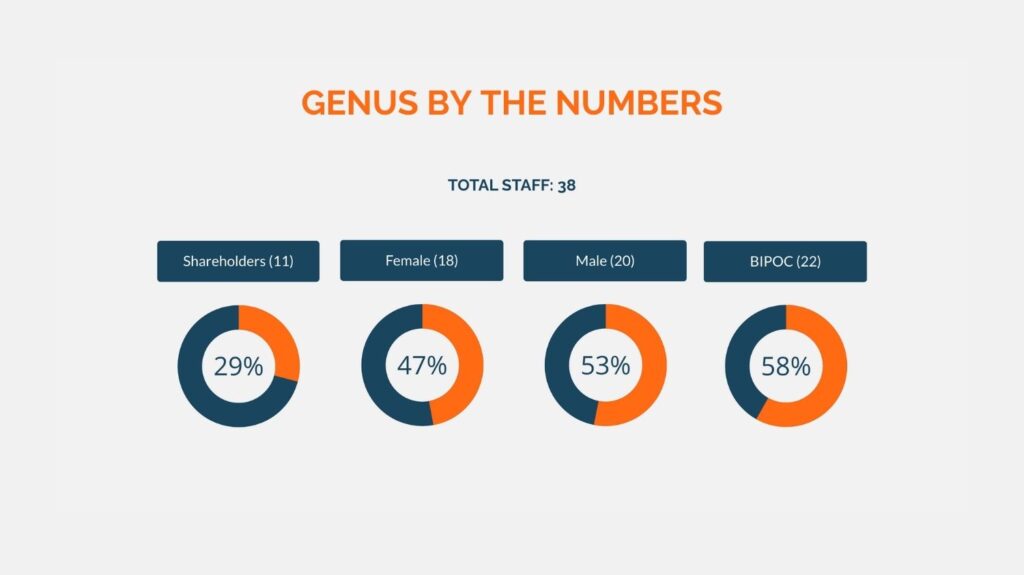

Since then, the diversity and inclusion in our asset management company has grown and evolved along with the firm. But it has always remained a strong and important part of our foundation and our stats today reflect these values. “It’s been kind of organic,” says Stephen Au, chief operating officer at Genus. “We always try to employ the best people to do the job, and those people happen to be from diverse backgrounds. That’s just who we are.”

I think one of the reasons we got a high B Corp score is because of our diversity. It comes from the top, and the firm mirrors that. It’s just what you should be doing

Stephen Au, COO, Genus Tweet

Strength in diversity

Many studies (several of which are summarized in this article on why diversity and inclusion are important for investment analysis) have shown that diversity brings strength to companies in the form of new ideas, broader perspectives, and innovative approaches to challenges and crises.

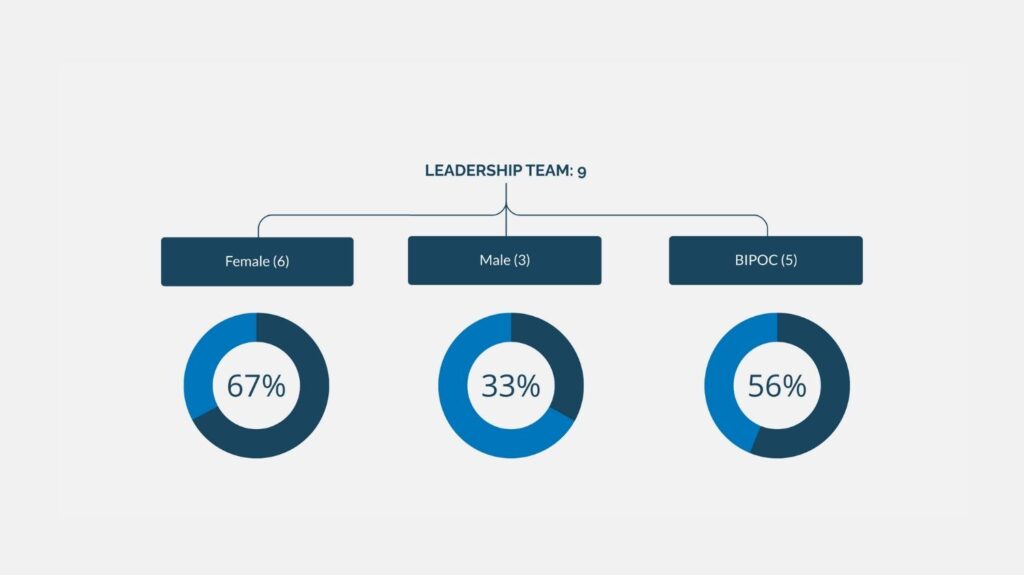

At Genus, we know first-hand that this is the case. “At the executive level, many diverse people have a voice,” Au says. “Sure, there’s a lot of disagreements, but diverse backgrounds bring different lenses to the issues. We all bring different assets to the team.”

I’ve never felt anything other than empowered here.

Sue-May Talbot, Portfolio Manager, Genus Tweet

Sue-May Talbot was the first employee hired at Genus, and testifies to the diversity and inclusion in our wealth management firm, and the opportunities she’s had to add her voice to company discussions and debates over the years. “I’m on the executive team and on all sorts of different committees,” she says. “I have a voice in a lot of different areas and I know that my voice is heard.”

After 30 years at Genus, which started at the reception desk, Talbot is grateful for the mentoring and encouragement she has received. “I made the coffee, I was the receptionist, I settled trades and I did the bookkeeping,” she says. “So I was in a good position, being exposed to all these different jobs, to pick and choose which ones I wanted to pursue. Leslie and Wayne supported me no matter what and I was lucky to be able to benefit from that. And that is a huge reason why I continue to be at Genus.”

Au says Wachell and the investment team also benefit from a broad range of experience levels in addition to various cultural and gender lenses. “We have a good mix of veterans and young people,” he says. “New recruits come in with advanced technology skill sets and if you meld that with experience, you get a great functional team.”

Investing with a firm that values diversity and inclusion is not only a good match for your values — it’s also good for your investments! Get in touch to find out more about how we apply diversity principles to your investment portfolio.

What Makes a Company Investable? A Look Inside Our ESG Investing Process